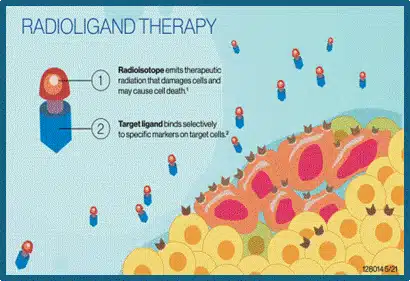

In the emerging landscape of innovative medical therapies, radiopharmaceuticals represent a promising frontier in the treatment of many diseases, particularly oncological diseases. These therapeutic and diagnostic agents, which contain radioactive isotopes, are used to diagnose and treat various diseases, including several types of cancer. The effectiveness of radiopharmaceuticals is based on their ability to selectively target diseased cells with almost surgical precision, minimising the use of more invasive treatments and reducing side effects on surrounding healthy tissue.

This specificity is achieved by using molecules that specifically target biological sites of interest, such as receptors or antigens expressed by cancer cells. Once in place, the radioactive isotope emits radiation that kills diseased tissue, an approach that has revolutionised the detection and treatment of cancers that are difficult to treat with other methods. Studies show a significant increase in survival rates and improved quality of life for patients, marking a turning point in the fight against cancer. The ability to combine diagnosis and therapy in a single treatment, known as ‘theranostics’, is a further step forward, enabling unprecedented personalisation of cancer care.

Type of RLT carriers

- Diagnostic isotopes can visualise cancer using positron emission tomography, ingesting radioisotopes to detect disease.

- Therapeutic isotopes can treat cancer (including alpha and beta emitters).

The innovation of radioligand therapies in the fight against cancer.

Radioligand therapies (RLTs) represent a significant development in cancer treatment and are positioned at the interface of medicine, chemistry and nuclear physics. The field has been shaped and developed by pioneers such as Advanced Accelerator Applications (AAA), which pioneered the use of these innovative therapies in cancer treatment and was later acquired by Novartis. Ligands can bind specifically to different types of “targets” or molecular targets expressed by cancer cells. Targets vary by cancer type and may include proteins, receptors or other unique cellular structures found on or within the surface of cancer cells. Unlike external radiation therapy, RLTs are able to treat systemic disease with less damage to the DNA of surrounding healthy cells, providing a more targeted and less invasive approach.

The radioactive isotopes used in radiopharmaceuticals can be of different types, each with specific characteristics that affect both the way the drug is distributed and absorbed by the body and the type of damage it can cause to cancer cells. For example, alpha particle-emitting isotopes such as actinium-225 and lead-212 provide highly localised and potent damage, ideal for treating tumours with dense cells. In contrast, beta-emitting isotopes, such as lutetium-177, are useful for treatments that require wider penetration of tumour tissue, useful in more diffuse or metastatic tumours.

This diversification in both the targets and the radioactive isotopes used allows treatment to be highly personalised, greatly increasing the chances of therapeutic success while reducing the risks associated with the treatment itself.

This targeted approach not only improves patient outcomes, but also represents a revolution in the way cancer is treated, leading to a new era of personalised and targeted medicine.

With these advances, RLTs are emerging as a promising frontier in cancer therapy, combining diagnostic and therapeutic precision in a single treatment modality, revolutionising the approach to cancer care with an integrated and highly effective strategy.

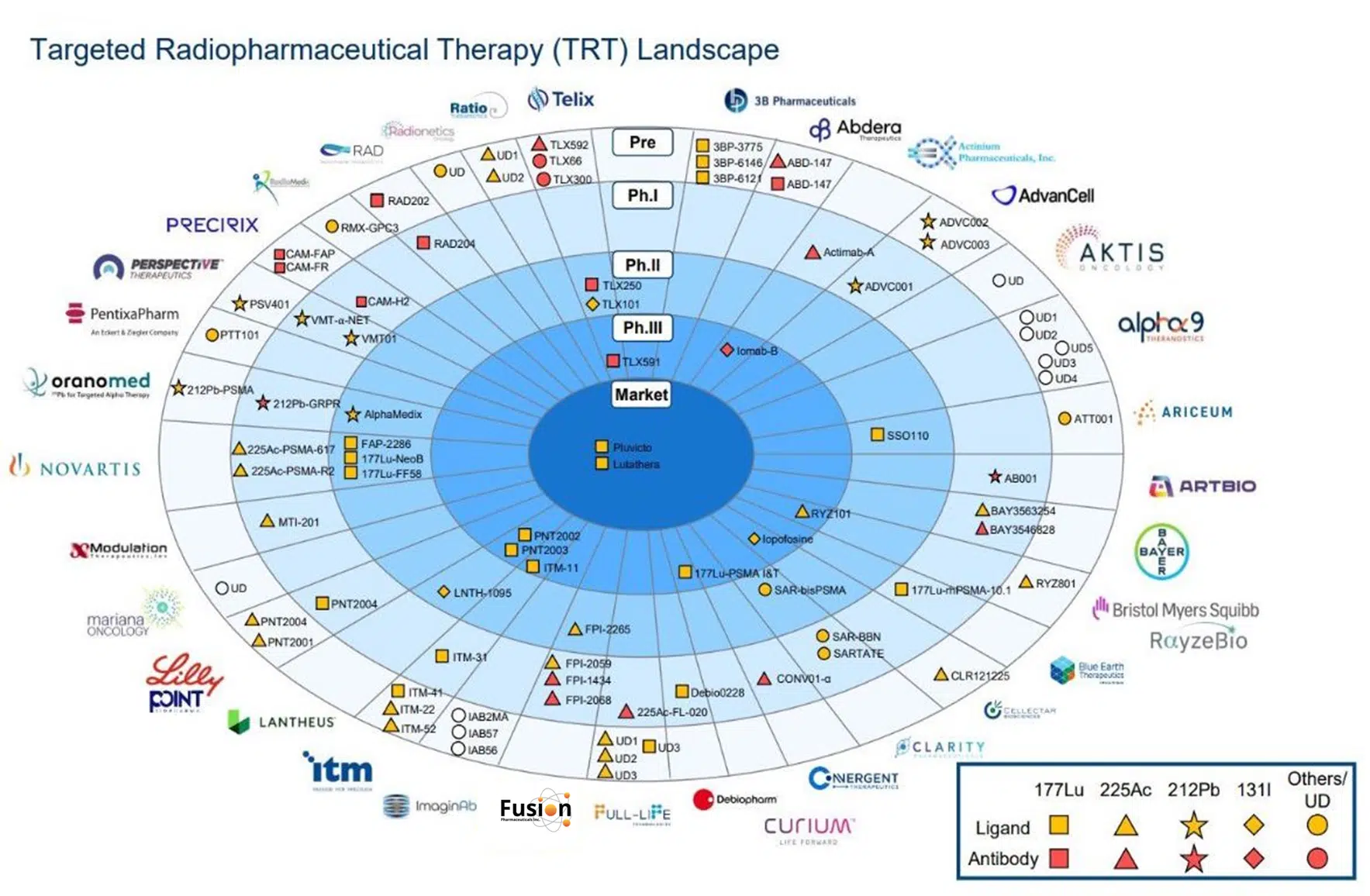

Market dynamics: the interest of big pharma

In a context of rapid development and high competitiveness, the landscape of radioligand therapies (RLTs) is characterised by its dynamism and the increasing number of players in the field. The field is driven by several dozen companies, some recently acquired by Big Pharma, that are driving innovation through the use of a variety of radioisotopes and target ligands. These advances not only confirm the efficacy of already validated targets such as PSMA and SSTR2, but also broaden the horizon to new targets that show significant potential in cancers where RLTs are not yet available to patients.

In terms of targeting strategies, most companies favour ligands other than antibodies; antibody-based RLTs have a higher risk of bone marrow toxicity due to their long circulation time, while ligands based on small molecules and peptides benefit from faster clearance and better tumour penetration due to their shorter half-life and smaller size.

Market structure and size

The global radiopharmaceuticals market is undergoing significant expansion and is expected to reach a value of $8.5 billion by 2031, with a compound annual growth rate (CAGR) of between 5% and 7.3% over the forecast period. This growth, from a current value of $6.2 billion in 2022, will be driven by several key trends shaping the structure and segmentation of the market.

The market is segmented by type (diagnostic, therapeutic), application (oncology, cardiology, neurology), radioisotope (leutetium-177, yttrium-90, technetium-99, gallium-68 and others) and geography, with oncology being the dominant segment due to the high incidence of cancer worldwide.

Driving Factors

A major driver is undoubtedly the expansion of personalised medicine and the parallel increase in cancer cases worldwide. This increase is leading to a move towards more personalised treatments, which in turn is driving demand for radiopharmaceuticals. These products make it possible to target specific cellular abnormalities in patients, offering more targeted and effective therapies.

Technological developments in diagnostic imaging and targeted cancer therapies are driving the use of innovative radiopharmaceuticals that can provide accurate diagnostic results and effective treatments for various types of cancer.

In addition, the increasing use of nuclear medicine in cancer treatment is further stimulating the demand for radiopharmaceuticals.

Increasing investment in R&D by pharmaceutical companies and academic research centres is crucial to the development of new radiopharmaceuticals and the expansion of existing clinical applications.

Finally, the dominance of the North American market: in 2020, North America, where Evergreen Theragnostic is based, held a significant share of the global radiopharmaceutical market, demonstrating the strong interest and rapid development of the industry in the region.

Limiting factors

Major obstacles include the high cost of developing and manufacturing radiopharmaceuticals: these are expensive processes, complicated by the need for specialised infrastructure and the safe handling of radioactive materials.

Stringent regulatory requirements are another limiting factor: government regulations governing the approval and use of radiopharmaceuticals are extremely strict, slowing the introduction of new products to the market.

The short half-life of many radioactive isotopes requires precise and timely logistics, which can be a significant challenge, especially in regions with less developed infrastructure.

Evergreen’s competitive advantage and LIFTT’s investment thesis

The scenario described is the competitive landscape in which Evergreen operates, which has several advantages:

- The experience of its team, stemming from the success of Advanced Accelerator Applications (AAA), and its advanced manufacturing capabilities;

- A state-of-the-art manufacturing facility in a strategic logistical location;

- A CDMO business that will already generate around $6m (23′);

- The out-licensing of a highly potent molecule for a specific target;

- The imminent launch of generics that will generate revenues in the short term;

- A proprietary drug discovery and development pipeline.

These are elements that outline a clear and concrete competitive advantage for Evergreen which, according to LIFTT, makes it an operator capable of overcoming the challenges of the radiopharmaceutical market and establishing itself as a key player in the global competitive scenario thanks to its unique know-how and established logistics-production strategy.