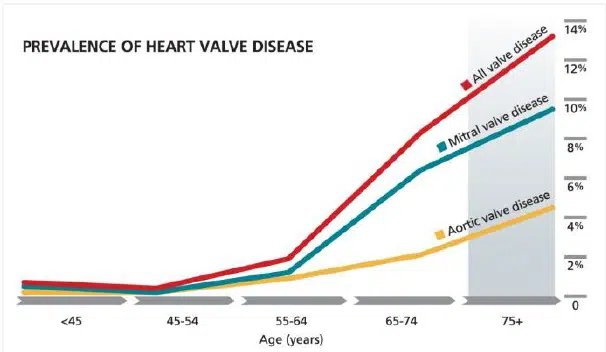

Cardiovascular diseases are the leading cause of death globally, claiming around 20 million lives each year[1] , accounting for 32% of all global deaths. The number of cases has almost doubled between 1990 and 2019 and this increasing trend has been confirmed in recent years[2] .

The reasons are inherent in the ageing population, the increasing prevalence of chronic diseases, generating a high demand for cardiovascular procedures and medical devices such as pacemakers, prosthetic valves and heart clips.

Specifically, the cardiovascular medical device market is worth USD 53 billion in 2021 and is expected to add over USD 92.5 billion by 2030, at a CAGR of 6.4%[3] . The majority of the global market share is controlled by three major companies: Edwards Lifesciences, Medtronic and Abbott[4] .

On the other hand, in 2021, the size of the global cardiac surgery market reached more than USD 14 billion and is expected to increase to more than USD 20 billion by 2027.

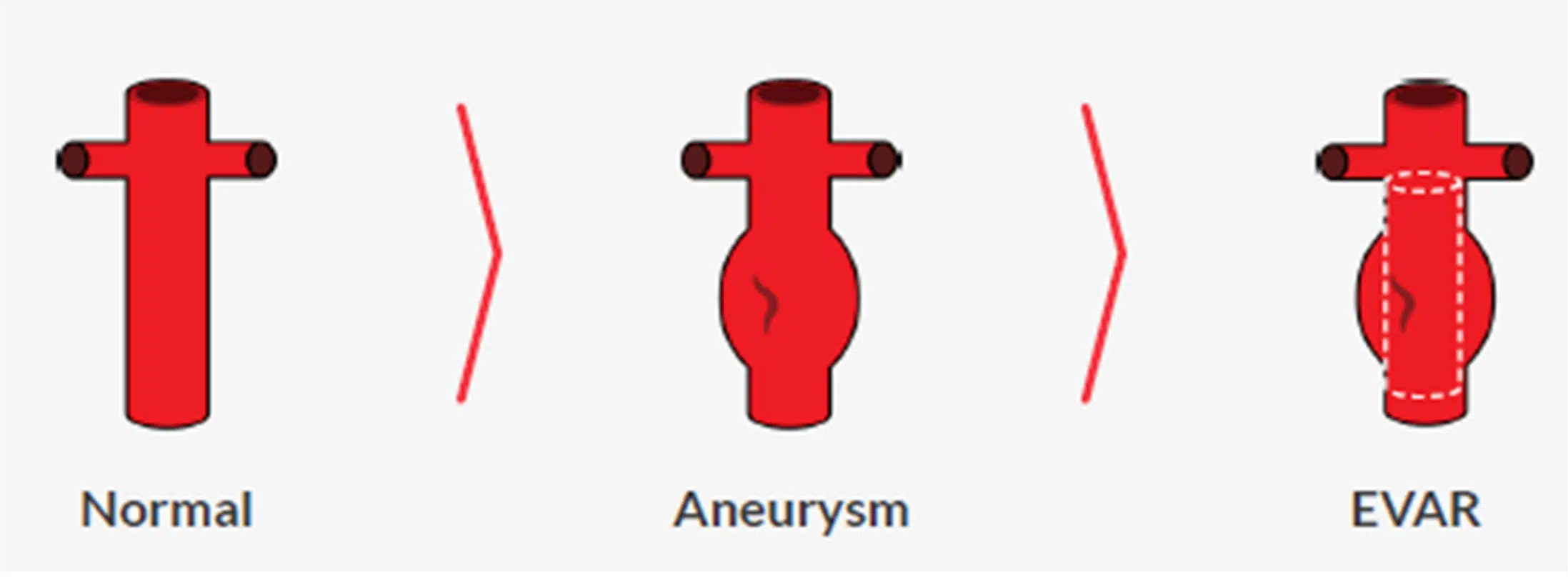

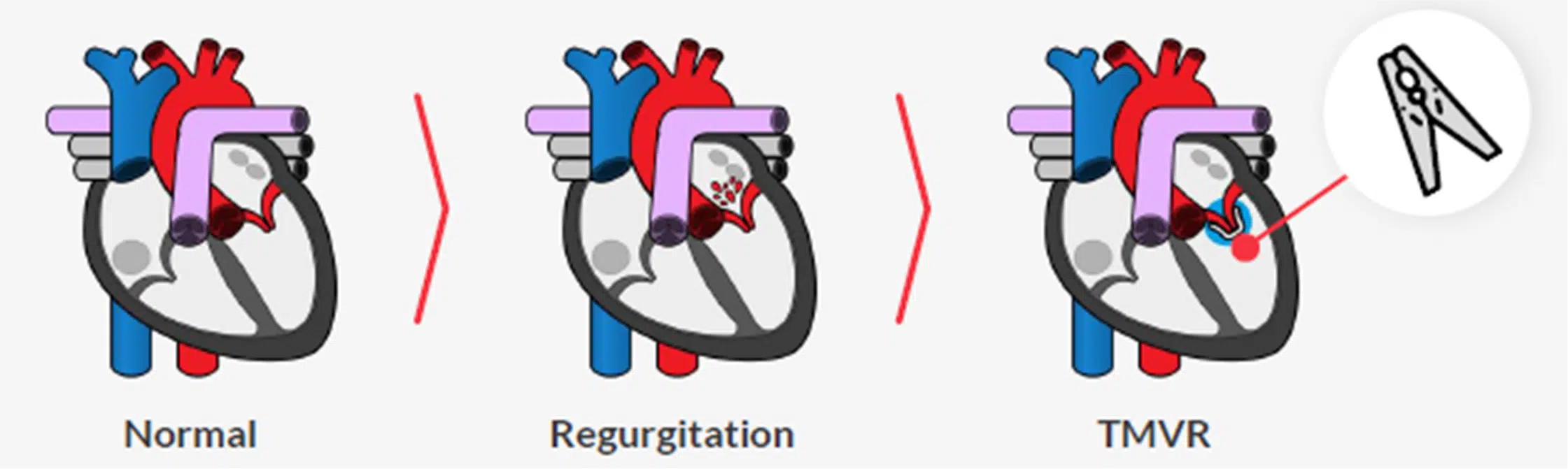

Among heart valve diseases, minimally invasive interventions such as endovascular aortic aneurysm repair (EVAR) and transcatheter mitral valve repair (TMVr), which account for 5% and 10% of all valve diseases, respectively, face several major limitations today[5] .

- Lack of quantitative parameters to select the treatment strategy;

- Low technical success rate of the procedures;

- Still lengthy procedures in terms of duration, with a significant radiation dose for patients;

- Sub-optimal outcomes often lead to re-interventions to adjust the position or sizing of the medical device;

- High rates of post-operative complications and mortality;

- Low patient eligibility rates

Moreover, these surgical problems limit the number of possible candidates eligible for the operation by approximately 50%[6] .

The value of their markets is as follows: (i) the global aortic aneurysm market: $2.7 billion in 2021 and expected to expand with a CAGR of 10.51% from 2022 to 2030[7] , (ii) the global transcatheter mitral valve market: its repair market was valued at $933 million in 2022 with a projected growth rate of 13.5% and a projected value in 2032 of $3.3 billion[8] .

Digital twins are helping to transformhealthcare through an integrated real-time approach to data collection and feedback. The main drivers for their increasing adoption are cost optimisation, improving and personalising healthcare services, and enabling the development of new medical devices and drugs.

Their market was valued at USD 463 million in 2021 and is expected to expand at a growth rate of 25.6% from 2022 to 2030[9] . North America dominated the market in 2021 with a share of more than 45%, while Asia is estimated to register the fastest growth rate of 29.4% from 2022-2030.

PrediSurge is a spin-off company from the Biomedical Engineering Centre of Mines Saint-Etienne, near Lyon in France. The company has patented an innovative digital twin technology using patient-specific numerical simulation, dedicated to cardiovascular interventions.

Its product, PlanOp, is a cloud-based digital simulation platform that helps cardiac surgeons to plan minimally invasive cardiovascular procedures such as (i) endovascular aortic repair (EVAR), including fenestrated aortic repair (FEVAR), and (ii) transcatheter mitral valve repair (TMVr), faster, easier with high accuracy.

This patented technology simulates the actual mechanical interactions between medical devices and the anatomy of interest, from CT-scans or 3D ultrasound scans, providing as output: (i) automatic implant sizing in less than 20 minutes (compared to a state-of-the-art of about 3 weeks, with additional costs for face-to-face meetings with the surgeon to refine the degree of customisation of the device) and with an accuracy of more than 99%, (ii) digital simulation of the patient-specific surgical procedure and testing of different approaches, (iii) prediction and prevention of post-operative complications, (iv) planning of the equipment to be used in the operating room.

Mathematical numerical simulation, compared to the geometric analysis of competitors, provides a high and more reliable degree of accuracy, also overcoming the competitive paradigm of providing primarily advanced visualisation tools for device diagnosis or sizing purposes. Predisurge goes further by providing details of the interaction between the device and the anatomy, predicting possible future and post-operative abnormalities.

The all-digital workflow designed by Predisurge offers benefits such as reduced time, reduced material waste, such as 3D models for the construction of the customised medical device, and related costs for clinical centres and medical device manufacturers. In addition, it increases eligibility rates for surgery (currently patients who are too frail for conventional surgery do not have access to less traumatic procedures), prevents secondary surgeries, and ultimately reduces the high risk of mortality.

Predisurge sells the on-demand simulation mainly to device manufacturers, through multi-year contracts with minimum annual orders, and to specific clinical centres.

In terms of market segmentation, Predisurge will primarily target European countries, through high-volume centres that guarantee rapid growth. Early adopters of the solution which is already on the market are leading medical technology companies such as Terumo, Medtronic and Abbott.

By 2024, PlanOp will be sold in North America, thanks to the KOL network and partnerships with manufacturers in Europe. Finally, in the fourth quarter of 2025, the solutions will be distributed in the Asia-Pacific region.